best buy 401k rollover

You roll it over and you buy a few mutual funds pretty immediately or if you roll it into your new employers plan it. Best for Low Costs.

10 Big 401k Plans Suspending Matching Contributions In 2020 401k Specialist

Ad Get Step-by-Step Guidance When You Rollover Your Existing 401k With Fidelity.

. Best for Low-Cost Mutual Funds. South Richfield MN 55423-3645 Telephone. Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

Top 401k Rollover Companies Summary Ally Invest ETrade and TD Ameritrade all have unique advantages that retirement savers will benefit from. Contact Your Current Plan. Take advantage of the May 2022 best 401K rollover promotions bonuses and deals.

Learn About Your Options at Schwab. Ad Discover Rollover IRA Features Benefits. This is the leading choice of other customers buying products related to 401k rollover to ira for dummies.

Usually when you get to your new employer they might have a 401k option as well. Fast Professional Independent Expert Business Valuation 3 days. Choose what type of new account to get.

Ad Discover Rollover IRA Features Benefits. Former Samsung Sales Representative in Crestwood Optional IL Illinois. It takes no more than two stepsas long as you follow the rollover rules.

One could also potentially keep his or her existing 401 k plan and buy physical gold or silver through a separate self-directed IRA account. Best for Low Fees. For more alternatives have a look at our catalog of 401K Rollover To Ira For.

In foreign exchange trading a loss caused by an unfavorable difference in daily interest rates between the currencies being traded. Simplified set-up and administration makes it easy to offer your employees a better 401k. Here are 10 of the top funds to include in your 401 k.

Second I could roll my money over into my new employers 401 k. Transferconvert your companys 401K employee account into a new IRA account at the. This kind of program is designed to create a separate account for each.

This PLAN is a DEFINED CONTRIBUTION PLAN. Best Buy Enterprise Services Inc. Choose which type of IRA account to open.

401k-type plans are controlled by your ex. Heres how to start and finish a 401 k to IRA rollover in. VWUSX Vanguard is known for its low-cost funds and VWUSX is no.

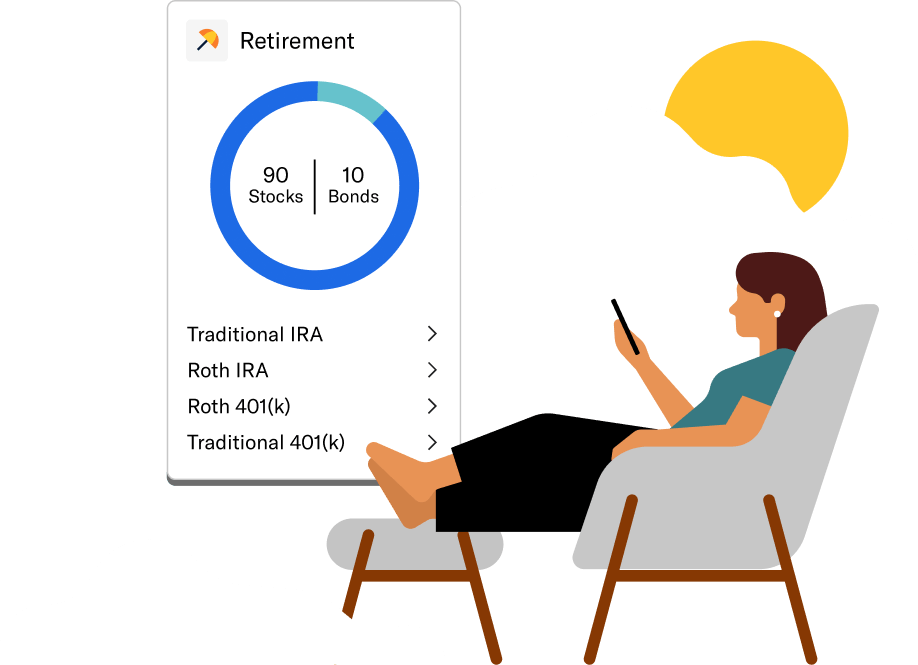

But the majority of 401k rollovers are pretty immediate. Ad Offer your employees a better 401k for a fraction of the cost of most providers. If you have a Roth 401 k or 403 b you can roll over your money into a Roth IRA tax-free.

Best for Mutual Funds. However you would then owe taxes on that money for the current tax year as Roth accounts are funded with post-tax dollars. Ad TIAA IRAs Provide Easy Account Opening Flexible Funding Options.

Best Buy Corporate Campus 7601 Penn Ave. Ad Offer your employees a better 401k for a fraction of the cost of most providers. Completing a 401 k rollover to a new 401 k plan is very simple.

An IRA may give you more investment options and lower fees than your old 401 k had. Best for Account Features. 1 day agoTo convert a 401 k plan into another 401 k or into gold this is what you should do.

If the account holder is under 595 years of age there is a 10 early withdrawal penalty. On October 1 1990 Best Buy created the Retirement Savings Plan. 1 the date you first contributed directly to the IRA 2 the date you rolled over a Roth 401 k or Roth 403 b to the Roth IRA or.

Ad No Upfront Fees - No Risk. The Best Places to Rollover Your 401k. Best for Combined Services.

401 k accounts from past employers can be. If you have a traditional 401 k or 403 b you can roll over your money into a Roth IRA. Best for Active Traders.

The Plan Sponsor sometimes called Best Buy is. O In many cases rolling a 401k to IRA can actually reduce costs or produce higher levels of financial planning advice for similar cost. Simplified set-up and administration makes it easy to offer your employees a better 401k.

TD Ameritrade is an excellent choice for. Great start up 401K since it was my 1st job. The 60-day transfer rule does apply and the gold must be.

Learn About Your Options at Schwab. 1 day agoGold IRA Rollover Rules. The 5-year holding period for Roth IRAs starts on the earlier of.

Because of this you cannot do the reverse and roll. Discuss doing a direct rollover. Ad If you have a 500000 portfolio download your free copy of this guide now.

Before doing this Meadows advised me to see what the fees are like and whether I like the investments my. You can roll over the funds from your Best Buy 401k into the new employers plan and effectively pay no. Best for Robo-Advisory Service.

Don T Forget To Roll Over Your 401k Synchrony Bank

Gold Investment News Buying Gold And Investing Your Ira Or 401k Into Gold Is One Of The Best Ways To Have The Secu Buying Gold Gold Investments Ira Investment

Rollover Your Ira Or 401k Into Gold Investing Buy Gold And Silver Buying Gold

What S A 401 K Rollover And How Does It Work Ellevest

401 K Rollover To Ira 4 Simple Steps Guide Sbnri

401 K Rollover To Ira Forbes Advisor

401 K Rollover The Complete Guide 2022

The Complete 401k Rollover To Ira Guide Good Financial Cents

Best 401k Rollover Options Free Gold Ira Rollover Kit Here Http Bit Ly 2dxjnga Investing Holiday Entertaining Investment Companies

Pin By Hashtagz On Stocks Money N Thangz In 2022 Changing Jobs Saving For Retirement Individual Retirement Account

401 K Rollover The Complete Guide 2022

401 K Rollover The Complete Guide 2022

The Learnvest Quick Guide To 401 K Rollovers Changing Jobs Ways To Save Guide

How To Roll Over Your 401 K And Why Ally

Roll Over A 401k Or Ira Rollovers

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

401 K Rollover How To Roll Over A 401 K

If You Are Looking To Diversify Your Wealth Then One Of The Best Options Out There Is Going For In 2020 Gold Investments Investing Investing Infographic